Beautiful Free Smsf Spreadsheet Template

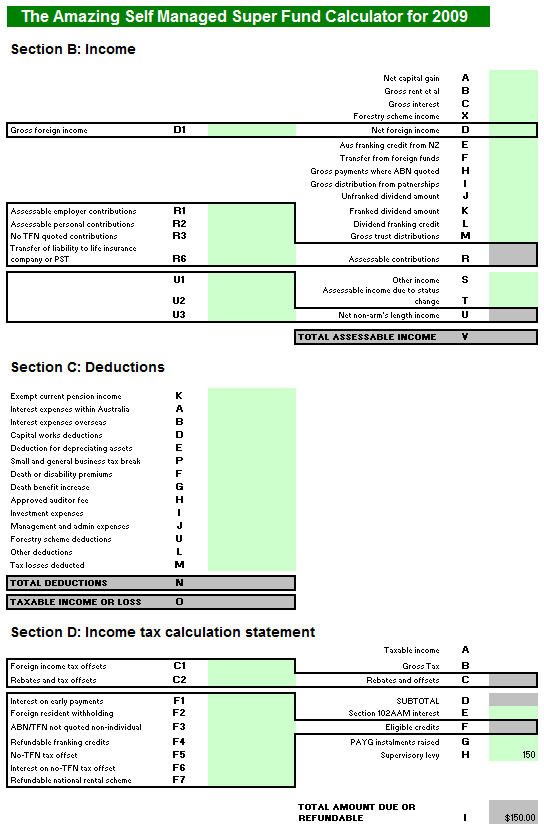

Self managed superannuation fund annual return 2017For use by self-managed superannuation funds to complete 2017 annual return.

Free smsf spreadsheet template. Family trusts are a common type of trust used to hold assets or run a family business. With the SMSFs USI number created at Step 5 above follow the manual entry steps below to link the SMSF to the employees fund details. PAYG withholding from interest dividend and royalty payments paid to non-residents annual report Introduction.

By forgetting to meet the pension minimums in the 202021 financial year the fund will now consist of a single accumulation account for John and Jean. Interest and unfranked dividends not reported on an annual investment income report AIIR. Their tax free and largely taxable income streams are now mixed together.

Self managed superannuation fund annual return instructions 2016For use by self-managed superannuation funds to assist in completion of 2016 annual return. Why you need Accountants Desktop. Make a list of all money coming in including.

If you dont have a regular amount of income work out an average amount. A family trust is an inter vivos discretionary trust which means it is established by someone during their lifetime to manage certain assets or investments and support beneficiaries such as family members. Accountants Desktop provides practitioners with the crucial tools they need to boost the productivity of their practice maintain quality control and guide new or inexperienced staff members.

Complete SMSF account and banking details. When all details have been entered click Save. Its not always necessary to purchase and install complicated accounting package programs when starting up a business.

An SMSF member can have as many pensions as they wish but can only ever have one accumulation account. There are certain advantages and disadvantages of family trusts for example if you are holding. Use the PAYG withholding from interest dividend and royalty payments paid to non-residents annual report for payments made to foreign residents for.