Beautiful Npv Sensitivity Analysis Excel Template

Although it might appear confusing and difficult to use.

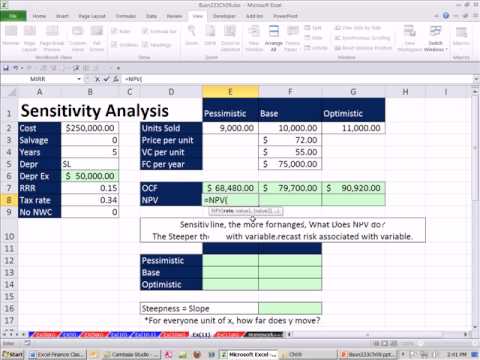

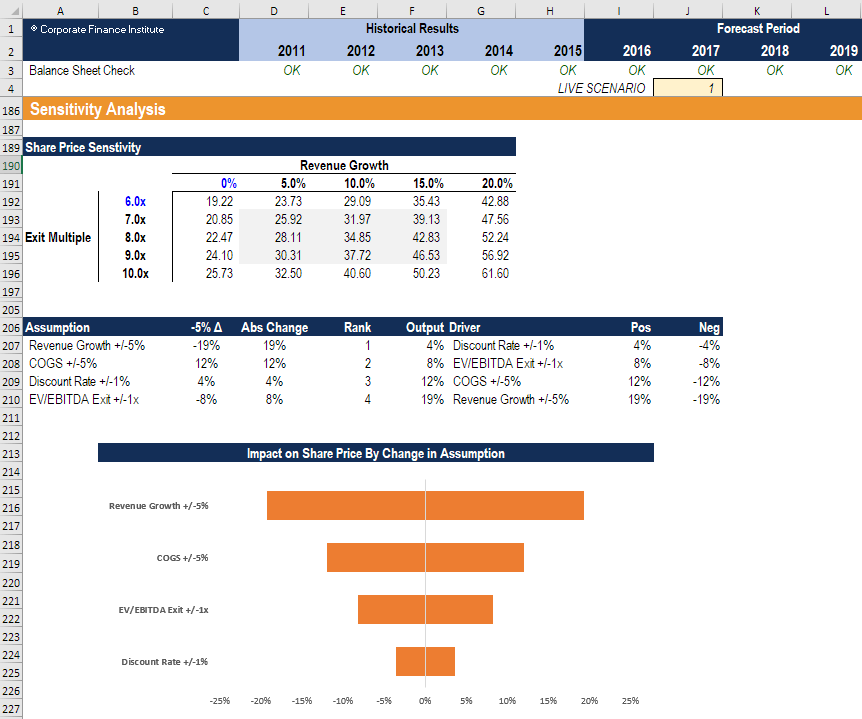

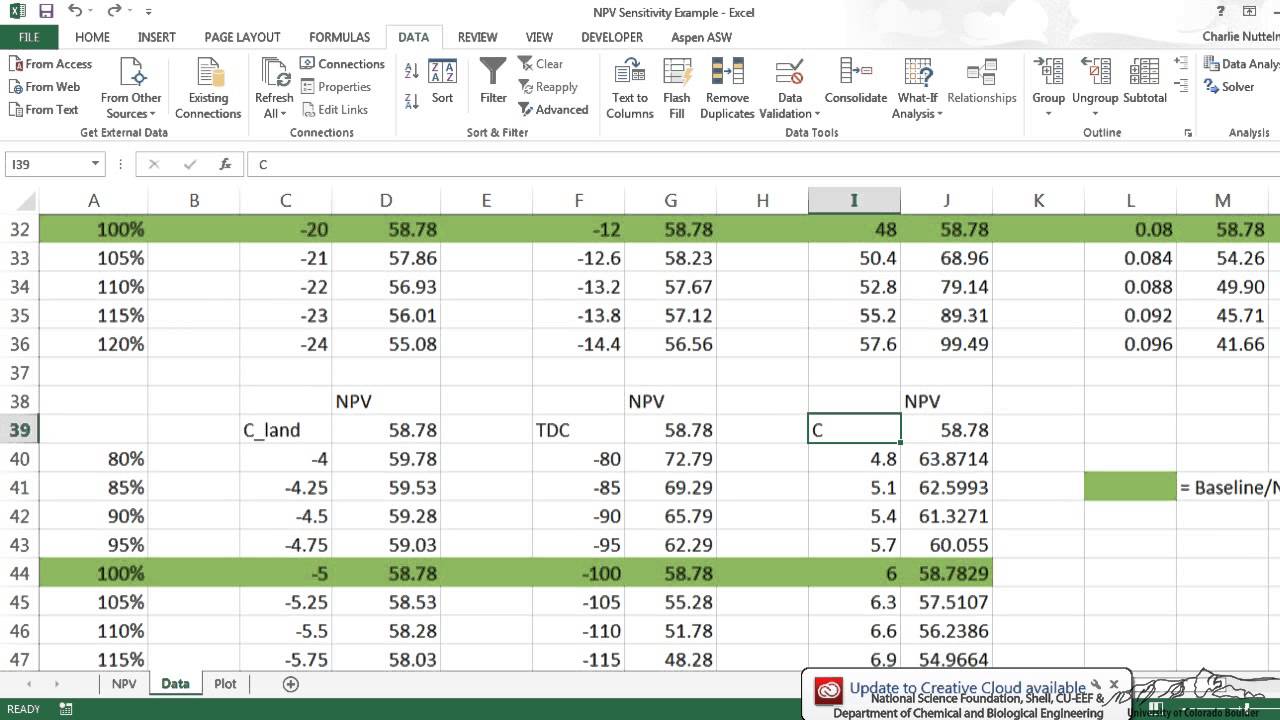

Npv sensitivity analysis excel template. Sensitivity Analysis With the Big vs. When they do so however it is not readily apparent how sensitive the value of NPV is to changes in multiple interdependent and interrelated variables. Changes in particular variables.

Financial analysts generally create static formulas for the computation of NPV. Chart Wizard XY Scatter Next Finish Consider two mutually exclusive. I final NPV of M final NPV of N Sensitivity graph.

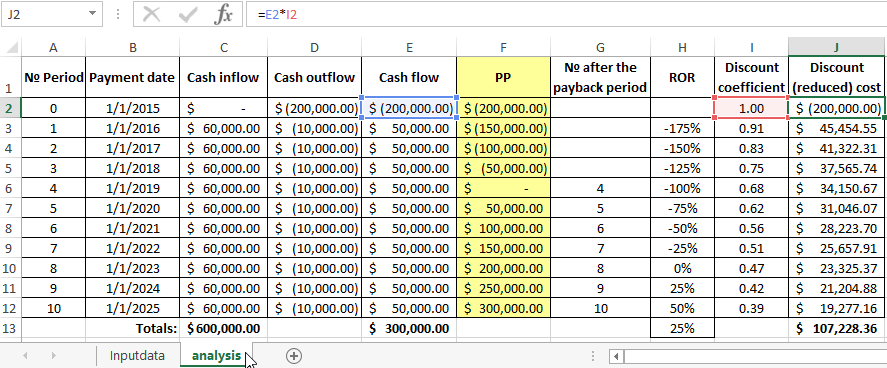

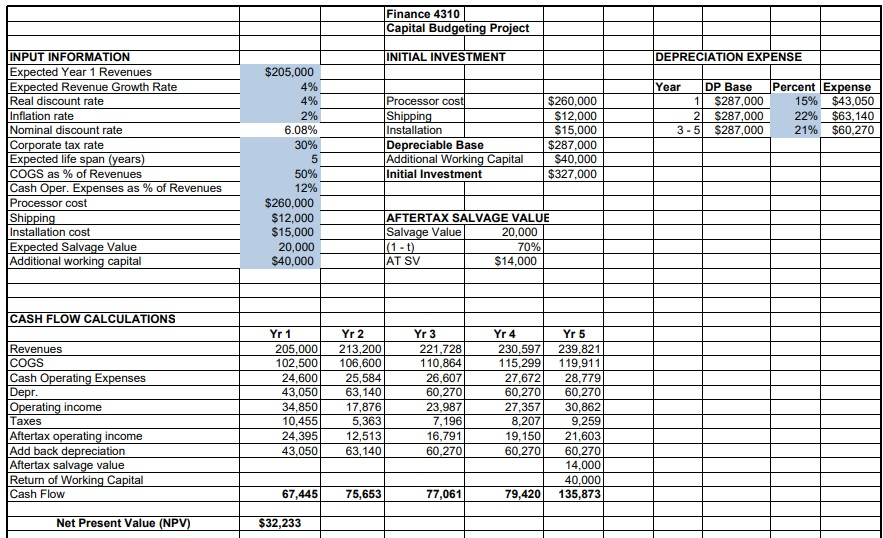

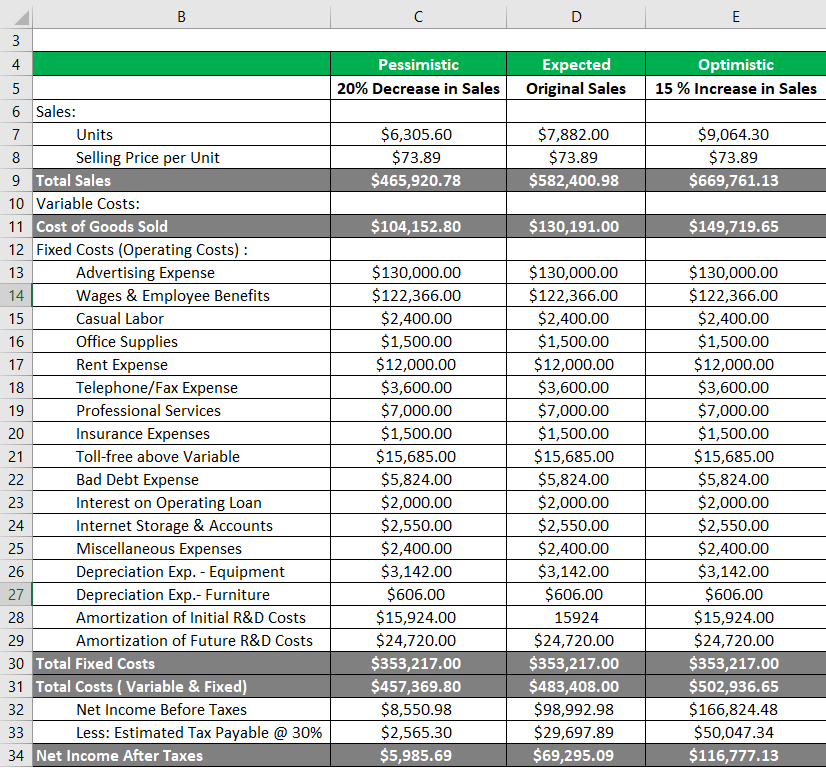

Sensitivity analysis is widely used in capital budgeting decisions to assess how the change in such inputs as sales variable costs fixed costs cost of capital and marginal tax rate will affect such outputs as net present value NPV of a project internal rate of return IRR and discounted payback period. However we assumed deterministic demand forecasts for years 1 2 and 3. DCF Sensitivity Analysis using Excel Data Table.

Includes unique visual analysis. Alternative M Alternative N Summary of sensitivity analysis. An example of a simple sensitivity analysis and how it affects the NPV calculation of a project.

If a projects NPV is computed and results in a positive value NPV 0 the project is then considered to be one that will if pursued result in an increase in shareholder wealth. Sensitivity analysis is a way of analysing change in the projects NPV or IRR for a given. Project A requires an investment of 1 mn which will give a return of 300000 each year for 5 years.

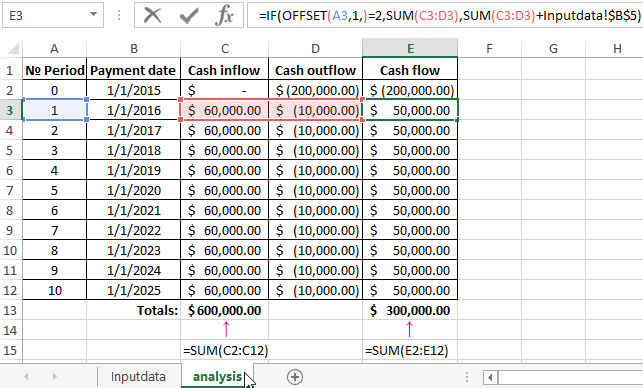

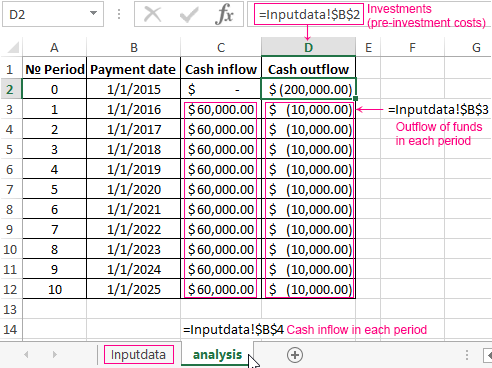

This excel tool was designed to fit into a financial analysis tool kit at the end of the modeling phase. Sensitivity analysis of the investment project download in Excel. What this means is after Year 0 through up to 10-year cash.